Last week was an especially interesting week for Malaysia. The Ministry of Finance, Central Bank and Securities Commission issued joint statements regarding the regulation of “crypto” – making it the perfect time to be on stage and openly discussing the future of security tokens.

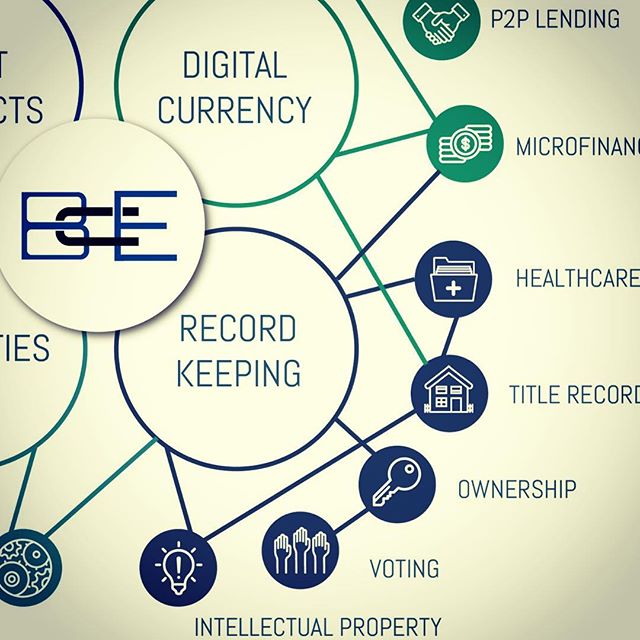

The week started with the announcement that the Securities Commission of Malaysia would be taking over all regulation regarding all digitally distributed assets with a blanket classification of everything falling under the oversimplified definition of securities. This means that overnight, every crypto-asset in existence (from native currencies such as Bitcoin and Ripple) and every centrally issued token (from crypto-kitties on Ethereum to loyalty points issued by IBM) were (if used like securities) now classified as traditional securities and in-turn regulated by existing laws and policies.

This also meant that the 47 registered exchanges and countless other services, businesses and individuals in Malaysia were effectively all of a sudden breaking the law by operating without approval from the securities commission. Perfect timing for some community meetups.

The first meetup took place on Tuesday the 15th. Our CEO was part of a panel at Unblocked KL. The topic was “What the future holds – how financial institutions can prepare for STOs.”

It was our opinion that the biggest concern regarding STOs should be that they will probably end-up abused in the same way that ICOs have. This will likely result in a few select people profiting at the loss of many individuals who do not understand the technicalities of what they are involved with. This seems to be especially apparent with the introduction of additionally confusing terms such as TSOs. They all feel like unnecessary acronyms invented as a way to side-step regulation. Newly introduced asset supplies do not become utility tokens simply because that’s what they say they are. If a token is not being used for anything other than exchange and speculation it is not a utility. This should hold true with both Security Token Offerings and Tokenized Security Offerings. If they are not attached to regulated securities then they are not security offerings. This is why we applaud the progress made by Malaysian regulators.

In essence, the regulators are now going through the process of securitizing tokens as a whole in order to allow the community to legally tokenize securities. I can think of few countries that are being as progressive whilst also remaining rightfully cautious at the same time. Despite the news from regulators, most questions directed to us on the panel were in regards to our recent work with Securities Commission. These questions and more were answered in detail on Thursday the 17th, when our CEO gave a one hour presentation and Q&A regarding Project Castor. It took place at the inaugural BUIDL Meetup that was organized by CoinGecko and FOMO Media.

What’s interesting with the approach that was taken by Project Castor is that it utilizes and demonstrates a number of notable standards. In order to facilitate real-time programmable investments from any wallet, the first goal was to introduce a KYC-based stable ERC20 supply that relies upon cash deposit and withdrawals with licensed trustee providers in the same way that Gemini (USA) and Circle’s (UK) stablecoins successfully function within regulated markets. It then uses non-fungible ERC721 assets to represent share certificates in the same way that OpenLaw is now using them to represent land titles and property deeds.

Despite the request for a more technical presentation, in which we briefly talked about deterministic key generation methods and the importance of upgradable smart contracts, most of the questions from the audience returned to the topic of newly introduced regulation. The answer we most often find ourselves giving at every event is that we believe there is and has never really been a reason to wait for new regulation as regulation for financial activities already exists. The thing most often misunderstand is that regulators do not regulate technology. If you want to allow for value to be stored or transmitted between users whilst obtaining funds from the public there are licenses and processes in place already. It doesn’t matter if you use a database, blockchain, pen, paper or google spreadsheet. It also shouldn’t matter if you are using Ringgit, Gold, Air-Time or Elephants as the underlying asset that supports the service, and yet …

Therein lies the confusion.

As the week ended, the Securities Commission provided a one month grace period for existing businesses providing public crypto-related services whilst also informing the community that all active ICOs need to make full refunds. They have not however clarified the situation regarding those businesses and individuals that have already completed ICOs or for those companies that are issuing their own forms of digital tokens and (or) assets. How does it affect CryptoCrabs for example? There are a LOT of unanswered questions, but at least we now know where to ask.

Some questions were asked so often that they even required further clarification from SC.

If you’re still at a loss as to what makes blockchain technology so special, or how it can be applied to financial services as a whole, you may be interested in our upcoming seminar with REDmoney, which is taking place on the 27th of February at the Intercontinental Hotel in Kuala Lumpur?

Social Experiences

Each user is given a space of their own and the ability to communicate and share with other users within the same or interconnected networks and groups that your organization establishes. Allow for private messaging or internal forums.